Polish up your approach to providing these five services, and show clients you're all about good medicine.

Polish up your approach to providing these five services, and show clients you're all about good medicine.

Q. I discovered that the owner of the practice I work at has been changing my invoices. Flea medications, shampoos, and glucosamine supplements are being charged to an over-the-counter charge, even though I sold them to the client at the time of the exam. Shouldn't those items fall under my production?

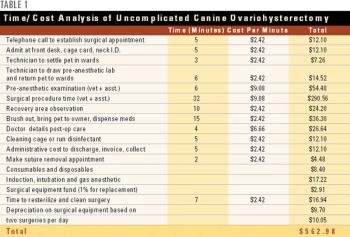

It's good to know the true 'cost' of money, and what every aspect of every service is costing you.

How much of your income is due to your performing surgery? Perhaps 15 percent? Even 20 percent?

Does your team know the practice starts out every day $900 in the hole?

Q. How will inflation and taxes affect my cash needs during retirement?

To increase parasite prevention and control compliance, make sure the doctors are in agreement about the standards of care and team members know what to say to clients.

Everybody loves detailed estimates. It's just that practices cannot afford them. The labor is just too costly.

Testing, treatment, and public health all play a part.

For many years, the risk of a tax audit was barely on the radar for most veterinarians, but today the chances that the Internal Revenue Service (IRS) will flag a practitioner's tax return for an audit are noticeably greater.

Q. I'm an associate who's paid on production only. Does this system discourage me from taking unpaid vacation days? Do I really even have any vacation time?

Don't let tax season strike fear in your heart. Play by the taxman's rules, and if he shows up for an audit, you'll be ready.

You've put it off long enough. Make time to check your numbers so you can make smart financial decisions for your practice.

Q. I'm looking to retire in a couple of years. How long would $600,000 last me if I withdrew $31,000 annually?

Any practice or veterinarian who fails to pay a required installment faces penalties.

If you're on the hunt for a new job, don't forget about the tax deductions you may be eligible for.

A colleague of mine was audited, fined, and required to pay back taxes for not claiming discounted employee pet care as taxable income on employee paychecks. He said that anything over a 20 percent discount must be taxed and listed as employee income. I checked with my accountant and he confirmed that I've been doing it wrong. How do I make changes in order to comply with IRS standards without upsetting my staff?

The giant retailer is honoring veterinary prescriptions and offering customers in 49 states a 30-day supply of more than 300 generic drugs for just $4.

You've admired those beefcake practices from afar. You envy their solid client growth and muscular marketing techniques. Well, here's how to supercharge your practice's growth.

Disclosing the practice's financial information helps team members see the bigger picture. But is this approach right for your practice?

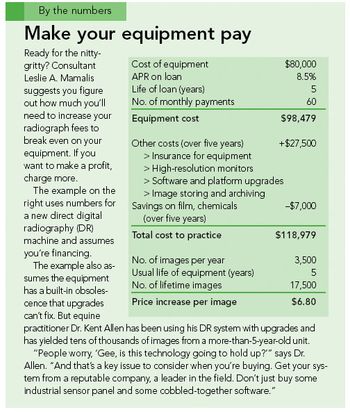

Will that new piece of equipment pull its weight in your practice?

How do the levels of accounts receivable compare in a companion animal practice to an equine practice? What's a reasonable level of accounts receivable for both?

You have nothing to lose and everything to gain. Implementing these ideas that boost the bottom line.

Will that new piece of equipment pull its weight in your practice?

Will clients embrace your new service? Crunching the numbers and weighing the pros and cons can help you decide.

You've bought new digital radiography equipment. Now where will your fees land? Will you just break even or make a profit?

Imagine an enjoyable - and educational - vacation, with Uncle Sam picking up part of the tab.

Clean up with 12 monthly resolutions for your best year yet! Plus! Three more must-do's from the experts!

Las Vegas - Fresh out of college, Dr. Carlos Vareli earns $72,000 a year and pays on $75,000 in education loans.

Competing on price is the biggest slip-up you can make. Here's why.