Despite efforts to repeal or replace, veterinarians still need to be aware of health insurance regulationsfor themselves and their employees.

Mr. Battersby is a financial consultant in Ardmore, Pa.

Despite efforts to repeal or replace, veterinarians still need to be aware of health insurance regulationsfor themselves and their employees.

Here's how to comply with a global security standard coming to the United States for the first time.

Without marketing or advertising, no one will know that your veterinary practice exists, so it?s crucial that your clinic has a marketing strategy.

Find out what the 2010 Tax Relief Act means for you and your veterinary practice.

With the season for filing 2008 tax returns well under way, all veterinarians should be aware of changes to the laws.

Skilled negotiation can lead to your benefit when entering into new leases, restructuring existing ones -- or getting out of a current one.

Talk about last-minute changes in tax laws that will affect veterinarians.

Market research and normal product testing costs are not considered research expenditures under the tax laws.

End-of-the-year sales aren't limited to just retail goods.

A surprising number of principals in veterinary practices depend on themselves for their financing needs. With conventional financing increasingly more difficult to obtain, it's now the No. 1 form of financing used by small business owners. It's quick, doesn't require a lot of paper work and often is less expensive than conventional financing.

In this age of disposables, many veterinary practices still pay substantial sums for repairs and maintenance. However, instead of allowing immediate tax deductions, the Internal Revenue Service increasingly is labeling repair and maintenance expenses as "capital improvements," making them recoverable only through depreciation spread over a number of years.

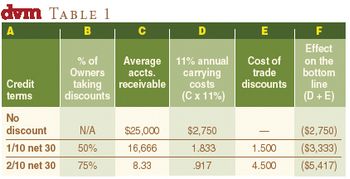

Discounts are a popular marketing tool to encourage clients and customers to pay faster. Many suppliers offer them to improve their cash flow. Like many professionals, some veterinarians offer a trade discount of sorts for immediate payment upon completion of services, but they may give little thought either to the cost of offering discounts or how much they might save by using discounts offered to them.

Limit on write-offs for equipment outlays raised, bonus depreciation for '08 purchases added

Today, with the 2007 tax year ended for most veterinarians, all that can be done before the filing deadline is to make the most of existing tax rules - all the while keeping an eye on the practice's potential tax bill for 2008.

Why would any veterinarian ignore perfectly good, legitimate deductions at tax-filing time?

The Internal Revenue Service is trying hard to convince everyone to file income-tax returns electronically.

It has been 17 years since the Americans with Disabilities Act (ADA) was signed into law. Although some veterinarians still fall short when it comes to making their business premises - and the practice itself - ADA compliant, others have used financial and tax incentives created to help ease the cost of complying with the ADA to improve and grow their practices.

With business loans becoming harder to obtain, many DVMs are turning to community banks.

Good will is one of those intangible business assets that usually has little or no impact on a veterinary practice's tax bill - until least expected.

Just as the Memorial Day holiday was about to begin, as lawmakers prepared to flee Washington for vacation, agreement was reached to continue funding the war in Iraq. That funding bill also raised the minimum wage.

A DVM must know all components of the deduction, and how much was spent for each.

Veterinarians who learn that a client filed for bankruptcy often wrongly assume that the practice has no options.

It's good to know the true 'cost' of money, and what every aspect of every service is costing you.

To many veterinarians, working capital is simply the cash they have on hand to pay their bills. Others may understand that it also includes such assets as accounts receivable and inventory.

For many years, the risk of a tax audit was barely on the radar for most veterinarians, but today the chances that the Internal Revenue Service (IRS) will flag a practitioner's tax return for an audit are noticeably greater.

Any practice or veterinarian who fails to pay a required installment faces penalties.

Imagine an enjoyable - and educational - vacation, with Uncle Sam picking up part of the tab.

Many veterinary practices operate in older buildings with leaky windows, poor insulation and patched roofs. Despite escalating energy costs, the harsh reality is few veterinarians are aware of the many incentives – both cash and tax incentives – available to help reduce that operating expense.

PSC assets can be protected from claims that result from malpractice of other professionals in the practice.

The IRS allows small businesses to reimburse employees for medical expenses.

Published: February 1st 2011 | Updated:

Published: August 1st 2011 | Updated:

Published: December 1st 2008 | Updated:

Published: February 1st 2009 | Updated:

Published: January 1st 2009 | Updated:

Published: June 1st 2007 | Updated: