An underestimated financial benefit exists for any practice that produces satisfied clients who have pets with well-controlled diseases that live longer lives.

Fritz Wood is a certified public accountant and a certified financial planner who consults with veterinarians and the veterinary industry. He’s conducted key research into the business of veterinary medicine and published many articles and presented at major veterinary conferences throughout the world.

An underestimated financial benefit exists for any practice that produces satisfied clients who have pets with well-controlled diseases that live longer lives.

Counterbalance the competition with these tips.

Move beyond sticker shock by reframing your prices.

What's the smartest thing to do first: pay down my debt or begin investing?

I'm a new associate immersed in my first contract negotiation. What are the benefits of a 401(k) vs. a Roth IRA?

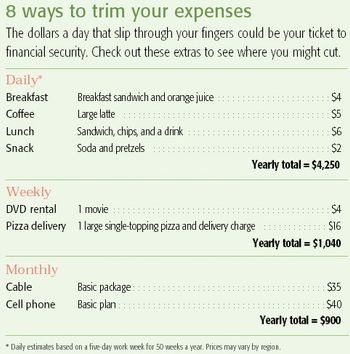

Personal financial planning is the process of organizing your financial goals into a workable plan so that you can live with financial security in the style you desire.

Internal controls are a system of checks and balances that help ensure clients pay for the goods and services they receive, and the practice's assets are safeguarded.

Congratulations! You are part of a very vibrant, healthy and fast growing industry.

Gross income in a veterinary practice can be broadly classified into two categories: active income and passive income.

Your existing clients represent a huge, untapped resource.

Congratulations! You are part of a very vibrant, healthy and fast growing industry.

Even in high-performing veterinary practices, hundreds of thousands of dollars "walk out the door" each year in terms of services and products that never got recommended or delivered, or if they where provided, were never charged for.

Personal financial planning is the process of organizing your financial goals into a workable plan so that you can live with financial security in the style you desire.

Personal financial planning is the process of organizing your financial goals into a workable plan so that you can live with financial security in the style you desire.

The practice owner at the hospital where I'm an associate won't invest in a new piece of equipment that I think we really need. How can I convince her to buy?

How to create an Excel spreadsheet that helps you figure the value of owning a clinic.

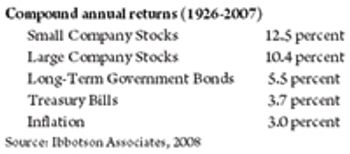

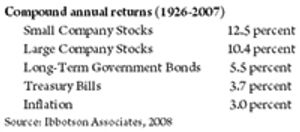

Maybe you can imagine happily working forever. But wouldn't it be nice if you didn't have to? Here's a growth formula to help your seed money blossom into a bouquet of retirement bucks.

Q. I'm looking to retire in a couple of years. How long would $600,000 last me if I withdrew $31,000 annually?

A colleague of mine was audited, fined, and required to pay back taxes for not claiming discounted employee pet care as taxable income on employee paychecks. He said that anything over a 20 percent discount must be taxed and listed as employee income. I checked with my accountant and he confirmed that I've been doing it wrong. How do I make changes in order to comply with IRS standards without upsetting my staff?

Is there a less complicated way to offer pet care to my employees than offering discounted services?

Are there programs that offer recent grads loan forgiveness?

Does a moment with your credit card statement feel like a moment in hell? Quit cowering and put out the flames for good.

Use these guidelines to decide when to send documents to the shredder.

Do you give this critical player the respect and responsibility she deserves?

How do I know how much I need to save for retirement?

Starting in October, it'll be harder for people to file for personal bankruptcy under Chapter 7, says Veterinary Economics Personal Finance Editor Fritz Wood, CPA, CFP. Under Chapter 7, debtors can wipe away unsecured debts such as credit card bills after certain assets are liquidated.

Small business owners are particularly vulnerable to the risks of a prolonged illness or disability, because they're often the business's main asset. In other words, the business's success often depends on the owner's ability to earn income. As a business owner, you need to protect both your personal and business income. And the right insurance provides that protection.

Published: April 1st 2008 | Updated:

Published: August 1st 2009 | Updated:

Published: August 1st 2009 | Updated:

Published: August 1st 2009 | Updated:

Published: August 1st 2009 | Updated:

Published: August 1st 2009 | Updated: