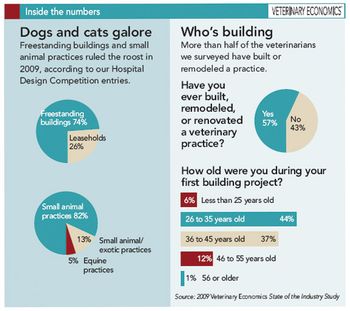

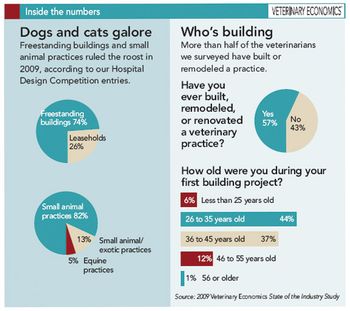

You know how much your facility cost to build, but what about other practices? Here's an inside look at clinics across the country.

You know how much your facility cost to build, but what about other practices? Here's an inside look at clinics across the country.

Find out how many practices have practice managers and how much those practices earn.

This veterinarian hired her manager 15 years ago and never looked back.

One of the more stressful times in a veterinarian's employment relationship is contract-signing or contract-renewal time.

Are the cats in your practice crying out for attention? Here's how to meet their needs and attract the best cat-owning clients.

Every veterinarian wants to write it. Here's a guide to teach you what it takes to pen a brilliant loan proposal.

A smaller animal can yield bigger profits.

I'm buying dental equipment. What additional costs do I need to be aware of?

One doctor hired a former banker to help guide him through the twists and turns of veterinary lending.

It's a scary time for veterinary practice owners, but that doesn't mean you should panic. Fritz Wood, CPA, CFP, offers advice for how to invest in a recession.

Building green is all the rage, but it can be tough to see through the fog of hazy information and ideas. Here's a guide to clearing the air and creating your dream earth-friendly hospital.

Going green is about more than installing energy-saving light bulbs. Use environmentally friendly materials to build a green hospital from the inside out.

The experts sound off on the attitude you should take and what practical ways you can compete

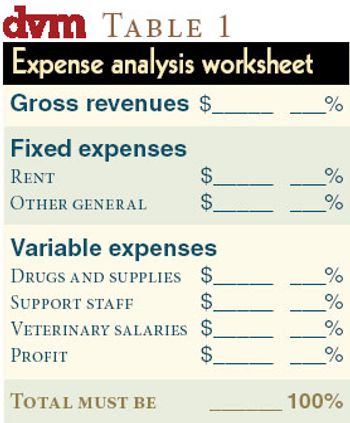

Get a grip on expenses.

What are today's biggest trends in veterinary hospital construction and design?

Combine staff training with an inventory count.

Drive-through windows give clients a convenient option for picking up medications.

Make the most of your money with an investment to refresh your practice.

There are lots of reasons for buying equipment. But whenever you contemplate a significant purchase, you should always be thinking about the return on investment (ROI).

We're ready to build a new facility. What are the most important things to look for in a location?

You can accomplish a lot with a little investment. Here are some creative ways to spiff things up.

A $30,000 investment can produce $200,000 in revenue-and minimal patient trauma.

The best way to prolong the efficacy of deworming programs is to use vaccinations and sound nutrition in conjunction with the right anthelmintics.

How can we determine whether to build a new practice or renovate our current facility?

The right levels of income, costs, fees, and clients lead to a strong, balanced veterinary clinic.

What do you do about missed fees?

Use this list to boost your practice's curb appeal.

Whether you're planning on building new or renovating an existing space, be aware of potential restrictions.

Integrate your facility's design with your business cards and other materials to help your marketing message hit home.

Leaseholds, renovations, and additions are as good as new. Take a look at what you've already got.