Q. How will inflation and taxes affect my cash needs during retirement?

Gary I. Glassman, CPA, is a member of the Veterinary Economics Editorial Advisory Board who has worked exclusively with veterinarians for more than 20 years. He specializes in accounting, tax planning, and practice transitions and is a partner with Burzenski and Co. P.C. in East Haven, Conn.

Q. How will inflation and taxes affect my cash needs during retirement?

Q. I take my practice staff out to lunch four times a year as a way to boost morale. Can I write off these lunches on my taxes as a business expense?

Don't let tax season strike fear in your heart. Play by the taxman's rules, and if he shows up for an audit, you'll be ready.

If you're on the hunt for a new job, don't forget about the tax deductions you may be eligible for.

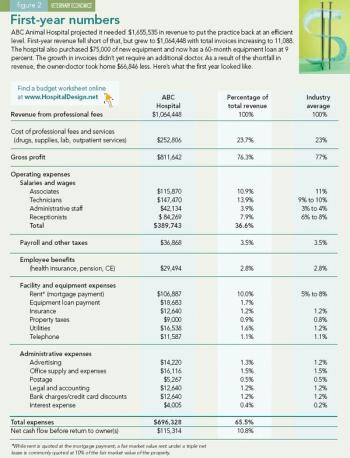

You've admired those beefcake practices from afar. You envy their solid client growth and muscular marketing techniques. Well, here's how to supercharge your practice's growth.

With enough employee participation, flexible spending accounts are a great benefit that attracts-and retains-solid team members.

What are my options for saving for retirement?

We'd like to keep our salaries low in order to minimize Social Security and Medicare Taxes. What's the minimum salary we can take so the IRS isn't breathing down our necks?

A new facility brings more space and capacity-and higher costs. Think about how you'll adjust now, so you spend more time enjoying your facility and less time worrying about paying for it.

I heard that a veterinarian was audited and fined more than $30,000 in back taxes for not claiming discounted pet care as taxable income on his employees' paychecks. I've been offering $300 in pet care per year per full-time employee (and half that for part-timers). If an employee goes over the $300 limit, he or she gets a 50 percent discount on additional care. Have I been doing it wrong all these years?

If you're considering selling part ownership to a valued associate, you need to know the tax traps for buyers and sellers.

There are tax advantages when you buy a hybrid automobile: a tax credit of up to $3,400, for instance.

"Accounts receivable in most small animal hospitals should never exceed 2.5 percent of the yearly gross income. For equine and other large animal hospitals, 4 percent to 5 percent of gross revenue is the norm," says Gary Glassman, CPA, a Veterinary Economics Editorial Advisory Board member and partner with Burzenski and Co. PC in East Haven, Conn. Most practices struggle because they lack good procedures to ensure collection, he says.

Relief veterinarians are typically treated as independent contractors responsible for their own income taxes and the reporting of their earnings and expenses. And most relief veterinarians conduct their practice activity as sole proprietors. Based on this, you'd report net income or loss from your relief practice on your personal income tax return. There are several important rules you should be aware of, however.

Starting this month, 401(k) plans can offer a Roth 401(k) provision?which could be a better option for your retirement savings.

I perform services at a discount for a local nonprofit group. Can I write off the discounts?

Q. I'm an associate veterinarian paid on a straight salary. My employer doesn't offer group health insurance as part of my contract, but I'd like him to pay my medical insurance premiums and those of my husband and son. I checked with the IRS, and it appears that he can pay the premiums for my family tax-free. If he offers me this benefit, does he have to offer it to everyone on salary?

Low costs aren't the only reason to choose a lender. Also consider these important details before saying yes.

My office manager wants to join a professional association and asked if I'd pay the annual dues. Should I? Should I do the same for other employees? Are the dues deductible?

Your banker wants to know whether you're a good risk-and you want to know you're getting a reasonable deal. Use these tips to balance the equation.

Not all tax deductions are created equal. When it comes to building projects, the normal write-off for building costs is 39 years. However, with a little homework and the help of a builder and architect, you can accelerate deductions. The concept at work: cost segregation.

Many practices are set up as S corporations for tax reporting purposes, enabling owners to receive dividend payments that aren't subject to Social Security tax. Doctors usually receive these payments when the practice pays for veterinary services and management.

The American Jobs Creation Act of 2004 created billions of dollars of tax breaks.

I'm thinking of paying my associate based on her production. If I do, how would I handle vacation days and holidays? She wouldn't automatically receive compensation for those days off, would she?

The Internal Revenue Service (IRS) cares about accurate classification of employees and independent contractors, but so does your state unemployment tax department. No one ever thinks he or she will get audited, and many practitioners are surprised to learn that state unemployment departments often audit more frequently than the IRS.

How much am I expected to contribute to my associates' retirement plans? Does this count as part of the compensation my associate earned based on production?

Looking to reduce your tax burden? Well, in 2004, you can expense up to $102,000 of new or used equipment purchases. A 50 percent bonus depreciation expense also is available in 2004, but it will expire at the end of this year unless congress extends the provision. Bonus depreciation applies to new equipment purchases and to leasehold improvements for those who own a practice but not the real estate.

My partner recently received information about her Social Security benefits. Should I have received a statement too?

Name the right beneficiary today, and save your heirs a big tax bill tomorrow

You know the benefits of offering a complete in-house lab. You--and anxious pet owners--can get quick answers on complex cases, and you can begin treatment immediately rather than hospitalizing the patient until you receive test results the next morning. In addition, owning high-tech gadgets lets you practice high-quality medicine.