Every veterinarian wants to write it. Here's a guide to teach you what it takes to pen a brilliant loan proposal.

Gary I. Glassman, CPA, is a member of the Veterinary Economics Editorial Advisory Board who has worked exclusively with veterinarians for more than 20 years. He specializes in accounting, tax planning, and practice transitions and is a partner with Burzenski and Co. P.C. in East Haven, Conn.

Every veterinarian wants to write it. Here's a guide to teach you what it takes to pen a brilliant loan proposal.

The downturn is still with us, but a solid grasp of how recent changes affect you will help your practice persevere-along with a great reminder system.

Government is subsidizing premiums, but employers pay up front

Does Uncle Sam owe you a rebate? Read this to find out.

You can still receive a tax rebate from your 2008 tax return.

Property owners and first-time homebuyers can take advantage of tax breaks.

New taxes could cause many veterinarians to rethink their investment strategies.

Download this Excel worksheet to figure your equine practice's inventory turns per year.

Carrying too much inventory can hurt your practice's bottom line.

Rather than waiting for depreciation, veterinarians can taka large deductions on equipment now.

Gary Glassman, CPA, talks up the benefits of letting your practice software watch your inventory.

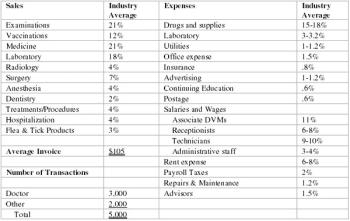

Providing a good explanation for your request and backing it up with a business plan is a good way to obtain favorable terms on a loan.

What kind of things will veterinary owners need to do for the development of the business owner's skill set?

Just like a yearly pet's physical, your practice should have a look under the hood at least yearly.

Budgets should an integral part of your overall financial plan.

Inventory is one of the most profitable and vulnerable segments of income generated within a veterinary hospital.

The veterinary team is a most influential element of practice management ensuring a well run and efficient hospital.

These audits can cost you, so be sure you correctly classify your employees.

Before you rent a leasehold, make sure you're satisfied with answers to these questions. Also available as PDF.

It's the question that every new generation of veterinarians faces.

How do I sell my practice's goodwill to a practice that could benefit from the potential business?

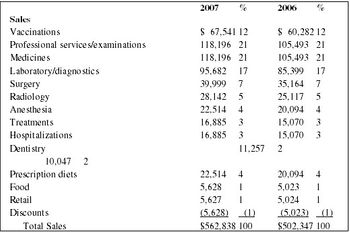

With the current economy, getting a loan is tougher than it was a few years ago. But good businesses are still bankable.

Before you rent a leasehold, make sure you're satisfied with the answers to these questions.

Many veterinarians pay their bills too quickly.

Know how your expenses are reimbursed to be sure you get the right deductions.

If you practice with partners, your buy-sell agreement is an important way to develop a plan to purchase an owner's interest under a variety of circumstances and to protect your own interest in those same circumstances-one of which is the death of a partner.

Your "construction allowance" is considered taxable income unless you follow these rules.

A printable PDF of the answers you need before buying into or selling a part of a veterinary practice.

These tips will help you duck common legal, financial, and communication oversights and keep you off the ropes during your transition to ownership.

Q. I'm concerned about my hospital's liberal employee discount benefit. Are there any guidelines I can offer the owner to keep him and the rest of the team safe from tax liability?