Get a clear picture of practice value

A potential buyer will want to know what it would cost to provide the same services you offer.

I first met Dr. Barry, the owner of an ambulatory practice in Virginia, in 1998 at a management conference hosted by the American Association of Equine Practitioners, where I was speaking on valuation and transition issues. Over the course of the next year, I found that Dr. Barry, while receptive to changes in his fee schedule, inventory management, and staff and associate compensation levels, couldn't understand why another veterinarian would pay good money to buy his practice when he retires in 2008.

Cynthia R. Wutchiett, CPA

After I explained the two main factors that determine whether or not a practice has value to a successor owner—the owner's return on investment (ROI) and the transferability of that ROI—Dr. Barry became more receptive to this idea. We even came up with some ways to improve his practice's value, so he could watch his investment grow. Here's what we looked at to determine Dr. Barry's practice value, how we could improve it, and how it could prosper with its next owner.

The ROI

The compensation you receive for the risk you take in owning a practice is your ROI, otherwise known as the earnings remaining after you pay operating expenses, including fair market compensation to owners and associates for their veterinary and management services. As a working owner, you may be compensated quite well for your services. But if there's no investment return left after the bills are paid, a potential buyer may decide to invest in another practice.

In the valuation of a veterinary practice, the owner's ROI, or expected earnings, is the primary component of goodwill value. And goodwill typically represents 70 percent to 80 percent of a practice's total value. So expected earnings are critical to anyone who is buying or selling a practice.

To calculate expected earnings and goodwill value, start with taxable income for the prior three years. Then make adjustments for:

- Income or expenses listed on the tax return that aren't included in the earnings calculation such as the gain on equipment sales and local income taxes

- Nonrecurring expenses such as repairs due to natural disasters, employee theft, and litigation costs

- Expenses not listed on the tax return that we include in the calculation of profit such as nondeductible entertainment expenses and owners' health insurance premiums

- Rent expense, if the amount paid isn't the fair market rent

- Underspending on facility repairs and maintenance, continuing education for all team members, and the true cost of services provided by the owner or the owner's family at little or no cost to the practice

- Economic depreciation as a cost of maintaining the current level of investment in medical and office technology and equipment

- Veterinary pay and owner-level management pay, if current compensation doesn't reflect the fair market value of the services provided.

The adjustments for the fair market value of veterinary and management services are two of the most critical. A potential buyer will want to know what it would cost him or her to provide the same medical and management services you offer. So we don't count bodies or even full-time equivalents. Instead, we look at the total dollar value of medical services provided at the doctor level and determine the fair market cost for providing these services.

We calculate the fair market cost as a percent of doctor-generated revenue. In equine practices, the percents used depend on how doctors provide services. For fieldwork, the common range is 24 percent to 28 percent, depending on your practice radius, staff assistance with farm calls, and the level of off-the-truck dispensing. For outpatient services provided at the facility, the range is 20 percent to 25 percent, depending on your technician-to-doctor ratio and the investment in medical technology and facilities. For surgical services, it's 16 percent to 22 percent, depending on staff member support, investment in medical technology and facilities, and the reputation of the senior surgical team.

The fair market value of management pay is based on a percent of total revenue—2 percent to 3 percent—or on the amount available to pay associates and owners for their veterinary and management services and to reinvest in the practice—6 percent to 10 percent. The total cost, plus payroll taxes, replaces amounts actually paid. Paying on the amount available, a truer measure of the owners' and managers' management skills, requires consistent record keeping and adherence to owner-approved budgets.

Common questions, clear answers

After making these adjustments, we determine expected earnings for each of the three years considered. Then a weighted average is used to arrive at one expected earnings number. For example, 2004 earnings would be counted three times, 2003 earnings twice, and 2002 earnings once. Then they'd be divided by six to find the average. This approach bases half of the earnings value on the most recent year's earnings and helps ensure the final practice value reflects recently growing or diminishing earnings.

Next, we reduce this weighted average expected earnings number by subtracting the current annual return on assets, or ROA, on the net working capital and tangible assets. This gives the final excess expected earnings number, which is multiplied by a capitalization multiple to determine the total goodwill value.

The capitalization multiple reflects the ROI required to attract an investor considering the risk associated with owning the practice. This equation weighs several factors, including the practice's expected revenue and profit growth, competitive position, management systems, staffing, extent and condition of facilities and equipment, and the transferability of owner's earnings to the new owner.

Besides goodwill, a potential owner is looking at your net assets, which make up the balance of a practice's total fair market value. These include such working capital as cash, accounts receivable, and drugs and supplies, as well as such tangible assets as office supplies, medical and office equipment, and vehicles.

The values for working capital assets come from the practice's balance sheet, and the remaining net assets' values come from estimates, appraisers, or accounting formulas, all adjusted to reflect fair market value—the price a buyer would pay for each item in its current condition. The balance of all outstanding debts and leases are subtracted from the fair market value to arrive at net asset value.

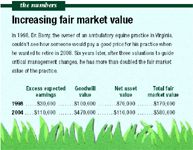

In 1998, Dr. Barry's practice was generating about $30,000 in excess expected earnings with a goodwill value of $100,000 and a net asset value of $70,000 for a total fair market value of $170,000. As a first step to help improve practice earnings, Dr. Barry and I answered the following five questions:

1. What are the practice's current earnings?

2. What do the earnings need to be to produce your targeted practice value?

3. If the owner's ROI isn't on track, what changes will you need to make to reach your target by the time you're ready to sell the practice?

4. Do you track owner's earnings by month or by quarter to monitor progress?

5. Are there management decisions that will decrease earnings in the short run but generate greater long-term earnings? If so, how will this affect the timing of your sale?

The Numbers Increasing fair market value

Then, I recommended a few changes to improve practice earnings. For example, I recommended Dr. Barry increase the exam fee and then increase fees for value-based services to be consistent with the exam fee, reduce the practice radius so he would spend less time on the road and more time with clients, and hire a full-time receptionist.

New owner ROI

In 2000, Dr. Barry hired Dr. Betty as an associate. Within two years, Dr. Barry could see that she had the skills and interest to be an owner. So as part of the revaluation of the practice in 2002, I discussed the valuation process with her. One of her first questions was, "How can I be sure that the earnings I buy will continue when Dr. Barry leaves the practice?"

Whether or not owner profits continue under new ownership is significantly affected by the seller's ability to transfer client loyalty. In fact, transferability is paramount in determining the capitalization multiple—and to developing the ROI needed to woo a potential investor.

In an ambulatory practice with limited facilities, the transfer of client loyalty may be the most important factor in evaluating future earnings. To preserve a strong capitalization multiple, plan the transfer of clients at least two to three years before a sale to provide the buyer time to prove himself or herself to the departing owner's clients.

You can orchestrate the ownership transfer in less than two years, but the capitalization multiple may be reduced. And if the departing owner is known for special talents or skills, such as reproduction or lameness, the transfer will take longer.

In referral practices, the issue of transferability may reach its highest risk if the production of owners' earnings is tied to one specialist's reputation. In this case, the transferability of client loyalty may require a four- to five-year plan to preserve a strong capitalization multiple.

As Dr. Barry's practice is primarily ambulatory, we established the following exit strategy for securing the transferability of his owner's earnings to Dr. Betty. You can adopt it as your own or modify as needed to fit your practice:

- Establish standard operating procedures for medicine and management. A new owner inheriting smooth-running systems will enjoy an easier transition than if the departing owner practiced seat-of-the-pants management. And the ownership transition will be smoother for clients, too.

- Bring in associates with the potential for ownership or merger partners several years before you plan to sell—even if it means you become the part-time or seasonal veterinarian for a short period.

- Prepare future owners. Don't wait until a week before you're ready to sell the practice to expose your associate to the sale process. Educate your soon-to-be-owner about the valuation process, the benefits of ownership, and financing options, among other things. (For a step-by-step timeline, see "Preparing Your Associate for Ownership" in the November 2004 issue.)

Last year, I revalued Dr. Barry's practice. As a result of solid management, the expansion of ambulatory and in-house services, and the addition of another doctor, his excess expected earnings are up to $110,000, goodwill is $470,000 and net asset value is $110,000 for a total fair market value of $580,000. With four years before retirement, earnings growth, and a transition plan, Dr. Betty and the practice's clients will be well prepared for the change in ownership.

Editors' note: This information is intended to provide general guidance only. As with all financial advice, check with your professional advisor before adopting any new succession strategy or technique or recommending a particular strategy for another individual.

The bottom line

If you invest in the stock market, you may check your stocks weekly or even daily. Your practice is likely a larger investment, so it makes sense to track progress and make adjustments regularly to meet your goals.

Veterinary Economics Financial Editor Cynthia R. Wutchiett, CPA, is president of Wutchiett Tumblin and Associates in Columbus, Ohio, a firm that provides practice management, employee development, valuation, and acquisition services for veterinary practice owners. Please send your questions or comments to ve@advanstar.com.